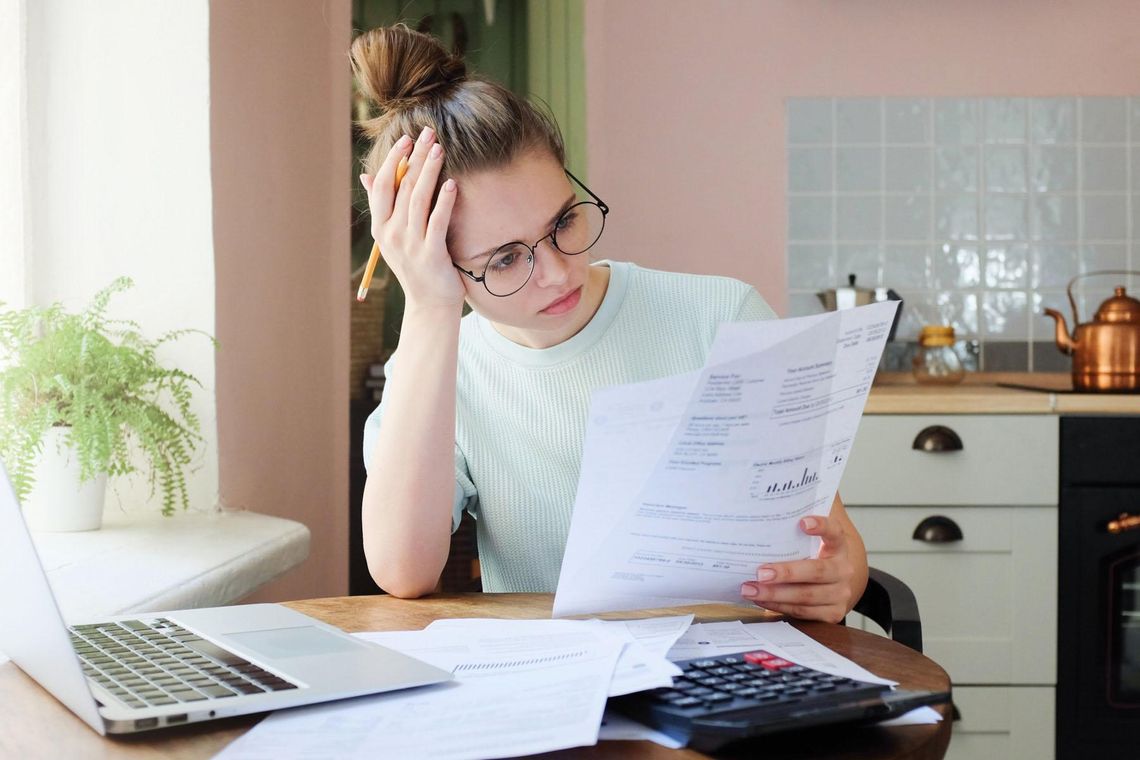

Student loan debt is a fact of life for many college graduates and their parents, with borrowers owing approximately $1.6 trillion in federal and private student loans in 2019. While some graduates easily repay their loans, others struggle to manage their debt.

Nearly one-quarter of respondents in a recent CFP Board/Morning Consult survey reported they or someone in their household has student loan debt. Only 21 percent of respondents with student loans were very confident they could manage and pay off their debt. Another 21 percent knew their student loan debt would be overwhelming and were not at all confident in their ability to repay.

The survey also highlighted the impact student debt can have on an individual’s ability to achieve important milestones, such as saving for retirement. Approximately one-third of respondents said it was unlikely they would be able to contribute to a savings or retirement account while paying off their student loans, while nearly 50 percent said they would not be able to fund an investment portfolio.

If you have student loans, a Certified Financial Planner (CFP) professional can provide competent, ethical advice on managing debt while building a retirement fund and balancing other financial goals. Here are five tips to get you started:

- Get organized. Borrowers may miss student loan payments simply because they’re unaware of the terms of their loans. Knowing how much you owe, to whom, and the terms of your loans can help you make informed budget and repayment decisions.

- Consider consolidating loans. Many students graduate with loans from multiple sources. Consolidating student loans simplifies repayment and may decrease the amount you pay monthly. However, keep in mind that consolidation isn’t the best strategy for everyone. Evaluate your specific loans and learn more about what consolidation might look like for you.

- Set up automatic payments. Automatic payment plans save time, stress and, in some cases, money. Some lenders will decrease the interest rate on your loan (usually less than 1 percent) as an incentive to set up automatic debit payments. Even a small reduction can save you money in the long run.

- Know your repayment options. There are several repayment plans for federal student loans. This includes options that lower monthly payments in proportion to income. Or, you can apply for a deferment or forbearance, which allows you to stop making payments for a certain period.

- Get employer assistance. Ask if your company offers financial assistance for school expenses or student loan payments. Although not directly related to student loans, if your employer matches employee retirement contributions, make sure you’re maximizing that benefit. Failing to make your own contributions up to that match is likely leaving a significant amount of money on the table. Finding a balance between all your financial goals is important.

For more debt management tips and to find a CFP professional near you who can help you review your options and determine the best plan for meeting your goals, visit letsmakeaplan.org. For questions or for more information about your specific loans, contact your student loan provider.

With the right information and assistance, you can better manage student loan debt while preparing for the future.